The discount disappeared – Nordic electricity price surge in January 2026

Customers who are currently receiving their January bills have noticed that they are much higher than both last month and January last year. A blocked high-pressure system with dry, cold and relatively windless weather has temporarily eliminated much of the discount compared to European electricity prices that the Nordic region in general, and Sweden in particular, has enjoyed since 2020. For northern Sweden, the increase means that electricity prices are more than four times higher than last year.

As we know, the risk of winter is greatest during the winter months, and a heating-driven increase in consumption is only temporary – with the arrival of spring, prices will fall back below European levels again. But what can January teach us about the margins at which the discount applies? How much can consumption increase before the threshold is passed structurally and Swedish electricity prices return to European levels, just as they were before 2020? In January 2026, we had a stress test that gives us an insight into how interconnected we are with neighbouring countries. The outcome of that stress test should prompt several players to review their exposures while there is still time.

Monthly average prices in SE1 - SE4, Nordic system price and Germany

Caption: Discount gone. Electricity prices in Germany were a bit lower in January than last year (blue circle), but the big discount that the Nordics and Sweden have enjoyed for a long time has almost vanished after just a few weeks of dry, cold, and windless weather. This gives a clear glimpse of the upside of electricity prices, even with structurally higher consumption. Source: Sigholm, Nord Pool.

The water level rises when the cup no longer overflows

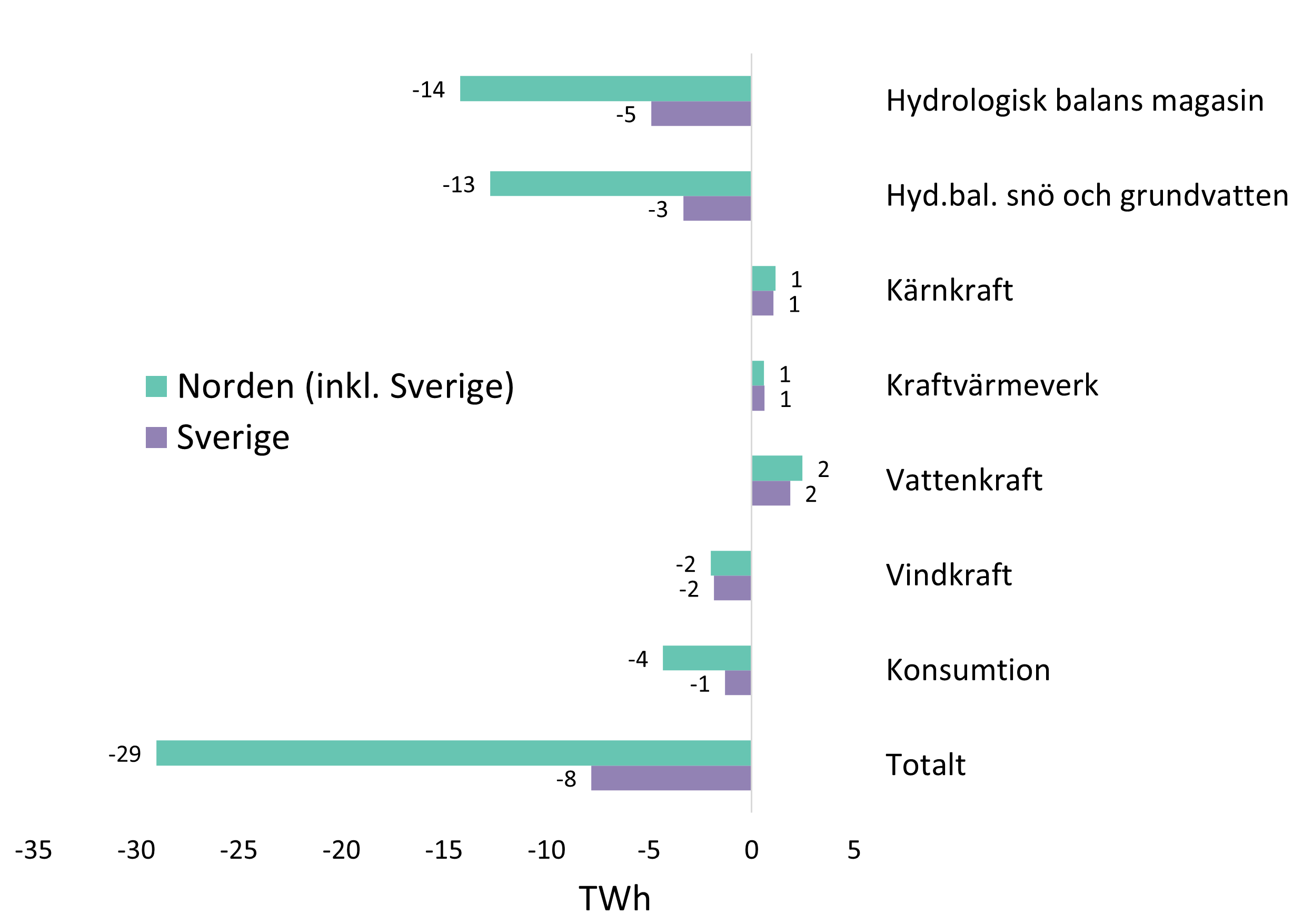

An examination of the fundamental differences in the electricity balance in the Nordic region and Sweden in January 2026 compared with January 2025 provides a wealth of information. The first observation is that nuclear power, hydropower and combined heat and power had a better January this year, more than compensating for the lower wind power production. In terms of production, January 2026 was therefore better than last year. Consumption was 4 TWh higher in the Nordic region and 1 TWh higher in Sweden.

Difference in electricity energy balance January 2026 minus January 2025

Caption: Fundamenta compared to last year. Apart from hydrology, there are actually quite small differences between January 2026 and January 2025, but enough to wipe out the discount that many players take for granted.

The big difference between now and then is the deficit in the hydrological balance, i.e. the estimate of the energy content in the reservoirs of hydroelectric power plants, snow and groundwater compared to seasonal levels. From being in surplus as recently as the turn of the year, the hydrological balance has rapidly deteriorated in the cold and dry weather. In week five, it fell to a deficit of 20 TWh, and the average deficit for January as a whole was 10 TWh. In addition, forecasts point to a continued deterioration. This can be compared with January last year, when the hydrological balance in week five showed a surplus of 15 TWh and an average surplus of 17 TWh for January.

The hydrological balance includes volumes in reservoirs, snow and groundwater. These parameters are important for the water value, which in this case is the monetary value of hydropower volumes. As snow accumulation, particularly in Norway, has lagged behind the seasonal average this year, it is expected that the reservoir volumes used today will be more difficult to replace, as the spring flood looks set to be smaller than usual. And as the dry and cold weather looks set to continue, the reservoir volumes should also last for a long time to come.

All this means that hydropower owners have good control over volumes and the value of water is increasing as they can set the prices they bid into the market for their production. And the highest comparable electricity price is in Europe, as both Sweden and the Nordic region are located in Europe.

A possible hint about the future

With the above fundamental understanding of how Nordic electricity prices are set, it is easy to conclude the following: Electricity prices in Germany will remain largely unchanged in January 2026 compared to January 2025, and the production situation in Sweden will not be particularly different. The big difference in electricity prices in the Nordic region is therefore found in the Nordic region, and this time mainly in Norway. As in almost all other markets, Sweden's electricity prices are not particularly Swedish.

In January 2026, a threshold was crossed. From a December completely dominated by the crushing electricity surplus that has been pushing down electricity prices since 2020, especially in northern Sweden, it did not take much for the situation to be completely different. For the Nordic region, 29 TWh was enough, half of which consists of expectations of a weak spring flood.

Given that this temporary deterioration of 29 TWh has been enough to completely change the price picture, it is a very important message ahead of the structural increase in consumption that we have already begun. The increase in consumption is driven primarily by three factors: economic recovery, the electrification of existing and new industries, and data centres for digitalisation and AI. Roughly speaking, these increases together will amount to between 80 and 110 TWh by 2035 in Sweden alone.

Add to this a similar development in our neighbouring countries, and the direction is clear: the price structure that many players today take for granted is much more fragile than they think. And just as the beginning of 2026 has empirically proven, the likely price increase will occur faster and more suddenly than most people anticipate. The clearest measure of Sweden's loyalty in responding to these signals is that the expansion of power production has almost completely stalled. And without a surplus, there will be no discount.

Today's risk management determines tomorrow's winners

The alternative to the ‘it's in the lake’ strategy, which so many large consumers are adopting as they enter the age of electrification, is traditional risk management based on classic portfolio principles and a long-term perspective. Steel, forestry and power should never be kept separate is an old Swedish industrial motto that contains a great deal of truth. The answer to how the Nordic region can extend its electricity price discount and how individual consumers can manage their risks when the upside is largely the same is to build a purchase agreement portfolio. This allows you to take advantage of the natural match between consumers, who need to buy, and producers, who need to sell.

The responsibility for proactively managing one's own risks has become particularly important in the wake of the energy crisis and since the energy agreement collapsed in 2019. The discount will probably disappear, because there is no better remedy for a low price than a low price – nothing stimulates consumption and inhibits production as much.